Enrollees of Medicare often find themselves without the coverage they need. There are a lot of holes left in coverage when only enrolled in Medicare Part A and Medicare Part B, also known as Original Medicare. There are two ways that these gaps can be filled: Medicare Advantage or Medigap.

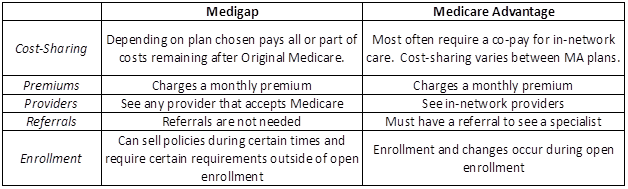

Although the two options are similar in that they offer health coverage beyond the generic hospital and physician benefits of Original Medicare, they are vastly different Medicare options.

Medigap

Medigap plans are supplemental insurance plans that are enrolled in to fill in the voids left by Original Medicare alone. There are ten different Medigap plans that beneficiaries can enroll in, plans A, B, C, D, F, G, K, L, M, and N. Each lettered plan offers the same coverage know matter what insurance company it is purchased from. All the plans with the same letter however offer the same exact coverage. Premium scan vary depending on where the plan is purchased through. No matter which state in the United States you live in, other than Wisconsin, Massachusetts, and Minnesota, the coverage you will receive in each of the lettered plans will be the exact same.

Medicare Advantage Plans can be chosen over Original Medicare. Medicare Advantage Plans offer more comprehensive coverage but under stricter guidelines. With MA, enrollees receive the same set of benefits, often more than, they would with Original Medicare however under different rules, costs and restrictions. Most often Medicare Advantage Plans require that you see certain in network providers, receive referrals for specialists, and might offer extras not found with Medigap such as vision and dental care.

If you decide to enroll in one of the plans over the other and later decide this is not the coverage that best suits your need you can switch during periods of open enrollment. There are a number of rules to familiarize yourself with when choosing coverage for your health care needs as you age.

The experts at eMedicare Supplemental Insurance, powered by Omega, have all the answers you are looking for when it comes to your Medicare Supplemental Insurance needs. More information can be found at https://emedicare-supplemental-insurance.com/.